Welcome to our site! Our editors have been covering the credit and debit card space for a total of 30+ years and we are proud to have been featured by the Wall Street Journal, CNN, etc. Your input is invaluable and we’d love to have your comments on What is a Prepaid Debit Card? (see below) – this site is powered by you!

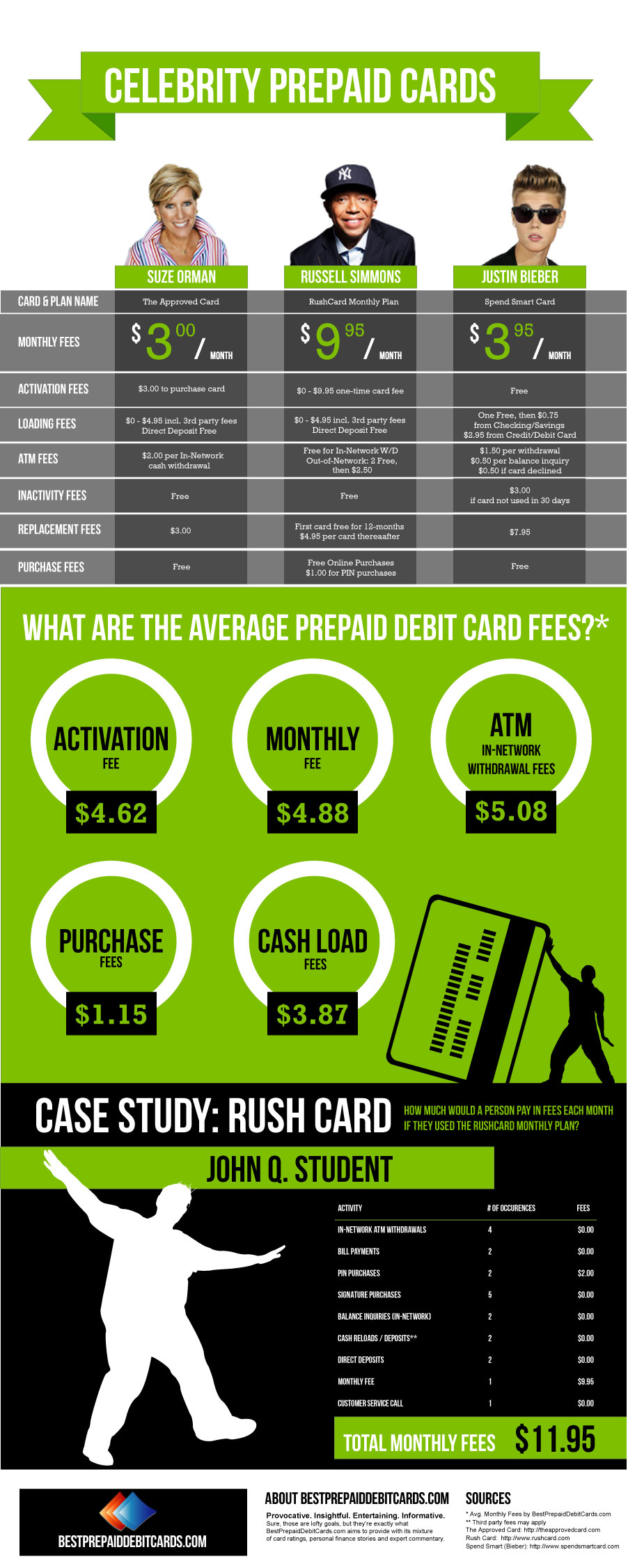

Courtesy of Linda Sherry, Director of National Priorities for Consumer Action, here is a comprehensive list of fees associated with prepaid debit cards.

by Lucy Lazarony

Looking for a new Debit Card, then you should check out the new award-winning No Fee Chime Visa Debit, (Ad Link) which can managed entirely from your smartphone and charges no overdraft fees, no monthly service fees and no transfer fees. No minimum balance is required and Chime features over 38,000 fee-free MoneyPass® and Visa Plus Alliance ATMs (there is a map of all fee-free ATM’s in the app).

This is the best and cheapest alternative to prepaid cards we have seen since we started reviewing prepaid cards over 5 years ago. And for a limited time, earn a Cash referral bonus of $50 when you tell your friends and family members about Chime and they sign up (and they’ll earn $50 too)- details within the app after you apply! Click for more info.- you can apply online in just 2 mins with no obligation- start by simply entering your email and clicking Get Started– over 3 million customers couldn’t be wrong. 🙂

What is a Prepaid Debit Card? Glossary and Common Prepaid Debit Card Terms.

Purchase fee. This is a one-time charge for buying the card, generally in a retail location.

Activation fee. A one-time charge that is also known as an opening fee, initial load fee or set-up fee, can range from free to $30 or more. This is a fee that must be checked carefully, particularly if you also have to pay to buy the card (see purchase fee above).

Monthly “maintenance” fee. This is a common fee that can vary widely, up to $10 per month; may be reduced or waived if monthly reload minimum is met or you set up direct deposit; some cards may also charge an annual fee.

Reloading fee. This fee is charged for adding funds to the card, which can vary by type or source of funds (cash, for example); third-party fees for cash loads made at agents (such as a participating chain of stores) also may apply.

Funds transfer fee. This kind of fee may be charged on certain funds transfers, such as from one card to another or from a bank account to the card.

Purchase transaction fee. This fee may be waived with a minimum number of transactions in the month or with direct deposit; may be charged on debit (personal identification number, or PIN) transactions and not on credit (signature) transactions, or vice versa.

Click HERE for our current ratings of the Best Prepaid Cards including the Best Overall No Fee Visa Card and see how this card compares to others.

Denied transaction fee. This fee may be charged if you try to make a purchase or an ATM withdrawal that exceeds your account balance.

Overdraft (or shortage) fee. This type of fee is charged by the relatively few cards that will allow you to spend more than you have loaded on the card; typically ranges from $10 to $25 or more.

Cashier withdrawal fee. This fee may be charged when cash is withdrawn at a bank or an agent location.

ATM withdrawal fee. A fee charged for withdrawing money from an ATM (unless the card offers free withdrawals at participating ATM locations or a certain number of free ATM withdrawals per month); another, separate fee of $1 to $3 is taken by most ATM owners/operators.

Balance inquiry fee. This fee may be charged for getting your balance statement at an ATM.

Foreign currency conversion fee. This type of fee is charged if you use your card outside the U.S. (typical for credit and debit cards, too).

Inactivity fee. This fee may be assessed if you don’t make at least one transaction in a certain period (typically 60 or 90 days).

Card replacement/reissue fee. This fee may be charged if your card is lost or stolen.

Paper statement fee. A type of fee charged for requesting a paper statement rather than viewing your statement online.

Customer service fee. Some card issuers charge this fee when you contact a live customer service representative (as opposed to using the automated help system); some cards may even charge a small fee for using the automated phone system.

Closure fee. This type of fee is charged when you close the card.