|

Please note that this 2018 review is outdated and is only kept for historical reasons. Please read our updated review of the TD Bank Go Visa Card here (that is in a better visual format).

If one of your New Year’s resolutions was to teach your teenager how to better manage money, TD Bank wants to help. A few years back, TD Bank, one of the ten largest banks in the U.S., announced the release of the Visa TD Go Card a few years back (when we first reviewed this card offer), its first foray into the prepaid debit card market.

TD Bank’s new prepaid card is aimed at helping parents teach their teenagers how to spend money wisely, albeit in a way that offers a sturdy safety net.

“The development of smart spending habits is a journey and many parents want to offer teens a gradual path to increasing fiscal freedom,” says Tami Farrow, Senior Vice President and head of retail deposit payments for TD Bank. “With the launch of the TD Go Card, TD Bank is offering parents a convenient and safe environment to get money to their teens and an easy way to monitor spending.”

New Popular No Fee Visa Debit Card (works like the TD prepaid card but with less fees):

Chime is a new type of bank account designed to help people lead healthier financial lives and automate their savings (people with poor credit can apply too as there is no credit check). With Chime, you get a free Chime Visa Debit Card (a real debit card, not a prepaid debit card which usually have a lot more fees).

Chime can be managed entirely from your smartphone. No overdraft fees. No minimum balance. No monthly service fees. No transfer fees. Over 38,000 fee-free ATMs, plus 30,000+ cash-back locations.

And for a limited time, earn a Cash referral bonus of $50 when you tell your friends and family members about Chime and they sign up (and they’ll earn $50 too)- details within the app after you apply! Click for more info.- you can apply online in just 2 mins with no obligation. Start by simply entering your email address and clicking “Get Started”– over 3 million customers couldn’t be wrong. 🙂 (Ad Link)

Here’s how the TD Bank prepaid card works. Parents can purchase the TD Bank Go Card online and fund it initially with a minimum of $20 and a maximum of $1,000.

Once the card is activated, which is partnered with Visa Buxx, parents have the ability to monitor how their child uses the card online and can also receive text and email alerts account balances, transactions and so-called “adult-oriented” purchases.

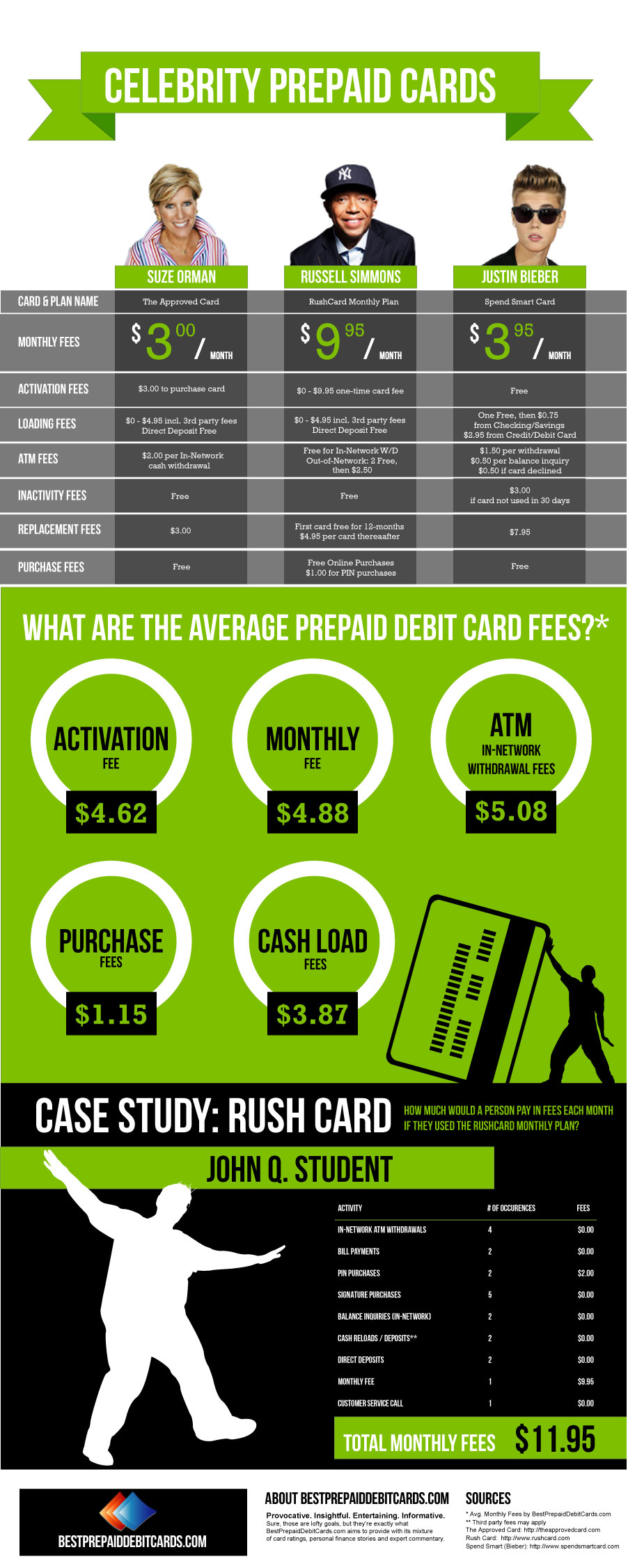

The TD Bank Go Reloadable Prepaid Visa Card (aka TD Teen Card) is by no means the first to market itself as a learning tool. Companies like SpendSmart offer prepaid cards designed with many of the same features as TD Bank’s new prepaid card. More infamously, celebrities like Justin Beiber have attached their names to prepaid debit cards meant to attract teens.

One thing parents and teens who opt to get a TD Go Card might learn is that using a prepaid debit card can sometimes be pricey. Depending on how a teen uses the card, the fees it charges can add up.

There is a $4.95 charge for purchasing the card initially and there’s a $1.00 charge to load it using either a debit or credit card (direct deposit is free).

Withdrawals from a TD Bank ATM are free, although taking money out of a non-TD Bank ATM costs $3.00, as does a balance inquiry at a non-TD ATM.

Requesting a paper account statement runs $5.00 and there is a $2.50 charge if the card EACH MONTH if not used for 12 months.

Go Visa Card Features:

24/7 access lets you easily spend, load and track your money

Set up transaction alerts, check your balance, reload your card on the go, and more with the TD Alerts app

Helps you budget – you can only spend what you put on your card.

How to Load Funds:

Load funds online* 24/7 using your TD Bank Debit or Credit Card

Direct deposit any amount from your paycheck

Deposit cash or checks or transfer funds from your TD Bank checking or savings account at any TD Bank

How to Open:

Bring $25 cash – no TD Bank account needed – or transfer $25 from your TD Bank checking or savings account

Bring your Social Security number and a valid ID (driver’s license, passport or state-issued)

Monthly fee is $5.99*

Per purchase $0

ATM cash withdrawals:

$0 in-network

$3.00 out-of-network

Reload Fee: $0

Is the TD Go Prepaid Card Good? (Summary):

Please note that this 2018 review is outdated and is only kept for historical reasons. Please read our updated review of the TD Bank Go Visa Card here (that is in a better visual format).

Please note that this 2018 review is outdated and is only kept for historical reasons. Please read our updated review of the TD Bank Go Visa Card here (that is in a better visual format).

The TD Go Card is a good card if you are an existing customer- the fees are definitely low. It’s also a good option if you are looking for a teen card for allowances. But the TD Go Card is not a great option for a general prepaid card.

Click here to search for the prepaid debit cards with different benefits than the TD Card (and at least in one case, lower fees) – read reviews and apply online in mins.

This is the best and cheapest alternative to prepaid cards we have seen since we started reviewing prepaid cards over 5 years ago. And for a limited time, earn a Cash referral bonus of $50 when you tell your friends and family members about Chime and they sign up (and they’ll earn $50 too)- details within the app after you apply! Click for more info.- you can apply online in just 2 mins with no obligation- start by simply entering your email and clicking Get Started– over 3 million customers couldn’t be wrong. 🙂

Finally, be sure to read customer reviews (complaints and praises) of the TD Bank Go Visa Card below and post your negative or positive review!

Related Prepaid Card to Consider:

The TD Connect reloadable prepaid visa card is offering (for adults- not teens). Read our full TD Prepaid Connet Card Review by clicking here. Please note that anyone can apply for this card – no TD Bank account needed.

Editorial Note!:

“The editorial content on this page is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone, including this review and the reviews written by actual cardholders below.”