The name says it all. When Occupy Wall Street became a household name a couple of years ago, the protesters were able to focus a light on the financial services industry and – at least in its view – the many harms it inflicts on the vast majority of citizens and the nation as a whole.

While the Occupy movement was successful in raising awareness about the activities of big banks and other financial players, there has been plenty of criticism that it was lacking in concrete accomplishments. In at least one very specific way, that looks to be about to change. In July, it was announced that the Occupy Money Cooperative was being launched and that its first product would be a prepaid debit card.

Recently, BestPrepaidDebitCards.com spoke via email with Carne Ross, a founding board member of The Occupy Cooperative, about the Occupy Card , why it chose to issue a prepaid debit card and how the group aims to change the financial services industry.

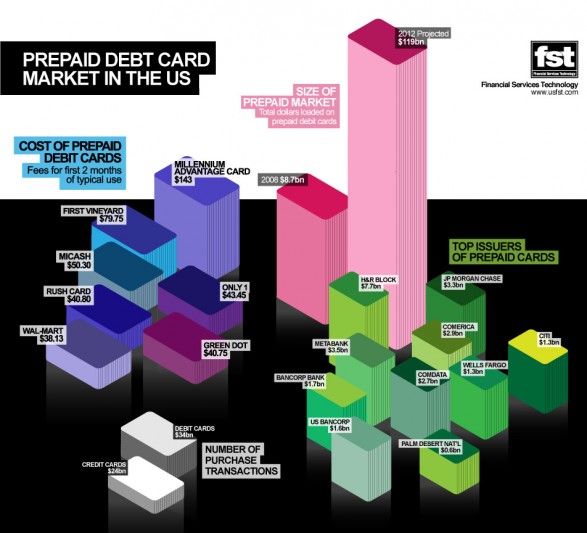

BestPrepaidDebitCards.com : Why is Occupy's first financial product a prepaid debit card? Is it because they have traditionally been such a bad deal for consumers? Or does it also have to do with the fact that this is a product that has a lot of potential?

Ross: We chose a prepaid card as our first product because it’s one area where the unbanked and underbanked are exploited by current providers charging excessive and often hidden fees. We have also realized that this is a dynamic market and we believe that we can offer a competitive product in the long run, because our costs will be low. Moreover, the more users for the card, the lower the fees, as we will be able to negotiate better rates as we scale.

BestPrepaidDebitCards.com: A breakdown of fees is important, even if it's estimates. Just how drastically will the Occupy prepaid card differ from other prepaid cards? Besides fees, what other ways will the Occupy prepaid card be different from its rivals?

Ross: I appreciate the questions but unfortunately I simply cannot even foreshadow the card’s fees and features at this point. We think it will be among the best deals on the market. Our aim is to minimize costs and pass these onto the consumer. We also think that the card will offer some good innovative features. Above all, if you use the card you become a member of the co-op that will offer the card, i.e. you become a co-owner of the company. You will have a stake and a say in how the co-op is run.

BestPrepaidDebitCards.com: Do you have an estimated launch date for the Occupy Card?

Ross: We do not. We hope soon. We are about to launch a campaign to crowd-source funding for initial operating expenses for the co-op. If successful – which we expect – we shall launch the card immediately. It’s ready to go. Until we launch the card, I’m not able to say much more, I’m afraid. We want to be super-transparent as a company, but some details we are required (legally) to withhold until the launch.

BestPrepaidDebitCards.com: What sort of impact do you expect the card will have on banking in general?

Ross: As we build up the number of users of the card, we shall soon be able to introduce further services that will shake up the current behemoths in the banking sector. These products will serve the same constituency as the card, wherever possible they will bolster the credit unions, provide low-cost choices, bypass the entrenched systems that rip everyone off, and brick-by- brick build alternatives for ordinary folk’s needs. I also should have been clearer in saying that because our costs are very low, we should be able to pass on any savings or benefits to our customer-members.