If you are shopping at just about any retailer, especially when making a bigger ticket purchase, it is likely you may hear a similar question at the check-out counter. "Would you like to save 20 percent on your purchases today?" Depending on the store, the offer will differ: it could be 10 or 15%, or some amount of cash back or whatever the store is currently offering to entice you to apply for their credit card. Who wouldn't want to save 10, 20% or even more on that day's purchases?

Whether you are planning a sizable purchase or series of smaller purchases, before signing up for that new store card, pause a minute to think about your current financial situation and goals for the new year.  Depending on where you stand with your credit score and planned loans, applying for two or more store cards could cost you much more in the long run than that $50 you saved on an impulse buying spree.

Depending on where you stand with your credit score and planned loans, applying for two or more store cards could cost you much more in the long run than that $50 you saved on an impulse buying spree.

It seems that cards are offered everywhere these days. You can get a store card from one of your favorite stores or a general purpose no interest APR credit card (most 0% offers are up to 21 months on purchases and transfers - click to apply for best offers) that you can use anywhere. You can also find store cards branded with logos such as American Express, Discover, Visa or MasterCard that offer store shopping as well as the ability to use the card anywhere else.

Interest Rate Hikes on the Horizon

The Federal Reserve recently raised rates for the first time in 2016 by a quarter of a percent. Three rate hikes are expected for 2017. With rate hikes predicted, now is a good time to lock in a low rate for balance transfers or larger purchases.

Examples of No Interest Credit Cards (General Purpose)

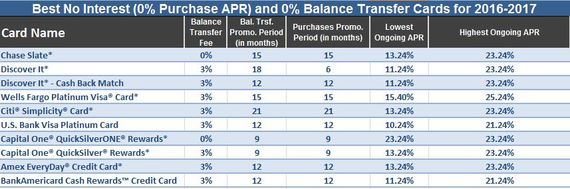

There are some great general purpose cards out there that are offering 0% on purchases and balance transfers. This allows you to do your shopping now and pay for it later. You could consider it your own personal layaway plan. Chase Slate is definitely one to consider which offers 0% on purchases and balance transfers for 15 months along with no balance transfer fee.

Other cards to consider are the Wells Fargo Platinum Visa® Credit Card* which offers 0% on purchases and balance transfers for 15 months or the Discover it® - Cashback Match™ card* which offers 0% on purchases and balance transfers for 14 months. These offers come with the industry standard 3% balance transfer fee, so if you are transferring balances along with any new purchases, that is something to keep in mind. For more of the best no interest and balance transfer cards, click here.

Note: Be aware that all credit card review sites are not created equal! Please see our note at the bottom of the article to see why we believe we are the most objective in the field. Most sites only list cards that advertise with them.

Store Cards 101

You may be familiar with general purpose credit cards but have some questions about store cards. So, exactly what is a store card, anyway? There are two types of store cards. Most people think of the traditional "closed loop" cards which can only be used at that store or within a select group of stores. There are also "open loop" cards that are cards with the store's logo and co-branded with a card-issuer logo such as American Express, Discover, Visa or MasterCard. These cards can be used at the store and anywhere else that accepts that logoed card. Both cards may offer special promotions, discounts and deals at their stores.

Store Card Examples

These are some typical store card examples you may find with stores near you.

Walmart

Walmart is running a card offer with special financing through the end of 2017. On items priced $150 to $298.99, you can get 6 months no interest as long as the amount is fully paid off within that time period.

You can also get 12 months no interest for purchases totaling $299 and up. Here's the catch: you have to pay these balances in full before the time period ends or the interest is accrued from the time of the purchase at the current rate (also called retroactive or deferred interest). If this happens, your rate will be 17.15, 20.15 or 23.15%, depending on your credit. In addition to the special financing, shoppers can save 15% on that day's purchases up to $25. Other perks: 3% back on Walmart.com purchases, 2% on Murphy USA and Walmart gas and 1% back at Walmart and on everything else.

Home Depot

Home Depot offers another store card with special financing. Shoppers can finance purchases for 6 months no interest on purchases of $299 and higher. Consumers can find financing up to 24 months on special promotions. Currently, they are offering 12 months no interest on special promotions of building materials, water treatment and heating and air conditioning offers. In addition, Home Depot cardholders can get one year of hassle-free returns which is 4 times their normal return policy. Home Depot has the same deferred interest program as Walmart. If you do not completely pay the debt by the deadline, interest accrues from the date of purchase. This can add up as rates on this card are 17.99, 25.99 and 26.99% (Ouch!).

A friend of ours knows how to wisely use store cards to save on interest. According to Kathy, an employee of a local school in Arkansas, "My husband and I took advantage of a Best Buy store card to finance some electronics and saved a bunch of money at a 0% rate for an extended period of time.

It worked like a charm! We were just very careful from a budget perspective to pay off the balance in FULL before the promotional 0% rate ended. The thought of paying "back interest to the date of purchase" really motivated us. I like the thought of taking advantage of these types of deals to manage our cash flow!"

Financing Purchases and Balance Transfers at 0%

There is more than one way to finance purchases at 0%. Many credit card and store card issuers offer no interest on new purchases, typically 6-12 months. This can be a huge help in managing your cash flow.

If you currently already have debt on another card or cards, you can also transfer that debt to a credit card (not a store card) where you will have zero interest for a limited period of time. For information on other factors to consider before applying for a balance transfer credit card, click here.

Here's the main difference between credit card financing and the special financing retail stores offer through store cards. The interest on credit cards is not deferred. That means you will not be hit by a huge interest bill if you fail to pay off the balance before the introductory offer expires (like you will with many, but not all store cards). You will ONLY owe interest on the balance moving forward after the promotional period (at a much higher rate). You will still be paying interest going forward either way, but with a store card using deferred interest, not completely paying the balance means you will owe all of the interest that has accrued from the date of purchase. This is a major difference.

Before selecting that store card and its special financing offer, it is a good idea to know the pros and cons of no interest credit cards.

Pros and Cons of No Interest (0% APR) Credit Cards

- Lower interest rates. Rates on store cards are typically in the high teens or higher (20%+).

- Higher credit limits. Typically cardholders will qualify for higher credit limits on general purpose cards.

- 0% Promotional Rates on New Purchases (without deferred interest).

- Transfer balances from other cards at 0%. Be sure to note balance transfer fees (typically 3%) and do the math before transferring balances.

- Make purchases anywhere. Many store-branded cards can only be used at the originating store or a specific group of stores.

- Earn rewards and cash back from multiple retailers or service providers. Many cards offer rewards programs. Getting 1-5% back over time can lead to serious cash back or savings on purchases.

- Lack of or different discounts and special offers. Cardholders may miss out on specific retailer purchase promotions, coupons, special sales, and discounts.

- Higher credit scores are needed. Typically general purpose cards offering 0% APR on purchases and balance transfers require higher credit scores to be approved. (720+)

Pros and Cons of Store Cards

- Store discounts, coupons and special offers. Retailers offer special incentives to encourage shoppers to apply for and use their cards.

- Lower credit scores are usually approved. (Folks may get approved with scores as low as the mid 600s)

- Opportunity to improve your credit score. These cards are great for building and rebuilding credit as lower credit scores qualify for many of these cards.

- Special 0% or reduced APR financing rates. These are similar to the 0% on purchases offered with credit cards, but mind the small print. Many offer deferred interest where if the balance is not completely paid in full, interest is accrued from the time of purchase.

- Higher interest rates. Many cards offer interest rates above 20%. :(

- Lower credit limits. Although great for starting to build or rebuild credit, lower credit limits can actually hurt credit scores due to the impact of the debt to credit ratio. If you are not planning on carrying a balance, these cards will improve your credit score as you will increase your available credit. If carrying a balance, the lower credit limit can negatively impact your debt to credit ratio which makes up about 30% of your credit score.

- Marketing of store cards appeals to our impulse purchase buying behavior and can lead to lowering your credit score if you apply for multiple cards within a short time.

TIP: Keep your debit to credit (limit) ratio below 30%. Your goal is to keep statement balances below 30% of the overall credit available. For example, if your credit line is $10,000 and you have a balance of $3,000 on that card, your utilization ratio would be 30%.

- Even if you do not activate a card, each inquiry to your credit report from card applications can temporarily ding your credit score by a few points.

- If you are planning on applying for a larger loan such as for an auto loan or mortgage, even temporary dings to your credit score can impact your rate on a longer term loan and end up costing you hundreds, if not thousands, in additional interest charges. For example, if your credit score is in the 750-760 range and you want a mortgage next year, you want to be careful. Even small drops in your score can have a big impact on the rate you may qualify for.

- Can trick you into spending more money. This is where you need to pay attention to your shopping habits.

Expert Commentary:

According to Steve Rhode, the "Get Out of Debt Guy", "The fantastic offers the stores attempt to trick you into falling for are designed to make them a lot of money over time. The stores will often give store credit to anyone who can fog a mirror and know those subprime consumers who can't get credit elsewhere will be more likely to fall for the offer, shop at the store, and get suckered into high store card interest rates. Your friendly store clerk is also motivated to push the store cards to get paid commissions for card application by customers. Always keep in mind, the only person looking out for you, is you."

Best No Interest Credit Cards List

We have compiled a list of the best no interest credit cards currently on the market. Click here for a printable PDF of the card table.

Conclusion

We have compared store cards and no interest 0% APR purchase and balance transfer credit cards. Only you know your current financial situation and goals. We typically advise general purpose credit cards over store cards as the rates are typically lower and the chance to transfer a balance to a 0% card can really help pay down debt. It is always good to look at the long-term impact. If you save $50 today only to have to pay an additional $50 per month for the next 15 to 30 years on a mortgage, have you really saved?

Based on your shopping habits, you may be better off with a general purpose card than a store card as it may be accepted at more locations. If you are trying to build or rebuild credit or your credit score is on the lower side, applying for and using store cards can be a big improvement to your credit score. Overall, it all comes down to how you will use the card and repay the balance. There are a lot of great offers out there.

We wish you well in your card research and selection and sincerely hope that you realize true savings as you pay your balance down in 2017. Click here for more information, including tips and tricks regarding balance transfer credit cards.

OTHER RESOURCES

Our Ratings/Disclaimer:

When reviewing these cards, we do our best to put ourselves in your shoes. We choose cards based on such things as maximizing savings through promotional interest-free periods, (lack of) fees, finance charges and ease of use. In other words, if we wouldn't use these cards ourselves, we wouldn't recommend them!

* NOTE: About 30% of the credit card offers that appear in this article are from credit card companies from which we receive financial compensation (these cards are listed as such on our site). They are noted above with an asterisk. We are proud that the majority of cards that we list (about 70%) are cards that don't advertise with us―- almost all of our competitors ONLY list cards that advertise with them.

The bottom line is that we don't know of another site that prominently lists as many non-advertiser cards! Please note that rates are current as of the publishing date of this article and should be verified prior to applying.

Co-written by Curtis Arnold, a nationally recognized consumer advocate and founder of CardRatings.com, the pioneering website that started posting the first credit card ratings online around 20 years ago, and Shane Tripcony, personal finance blogger and web marketing consultant. Curtis and Shane are the founders of BestPrepaidDebitCards.com, which provides ratings and reviews of prepaid cards and credit cards.

(Photos from Adobe Stock)

Looking for the best deal before you buy? Take a look at HuffPost Coupons where we have hundreds of promo codes from brands you trust, including a Home Depot promo code.